GIV Partners’ strategy has a key focus on absolute return and capital preservation, allowing investors to derive high risk-adjusted returns from a balanced approach that combines stable income flows with capital growth.

A strong discipline, built around the Company’s Investment Principles of focusing on Fundamentals and actively Creating Value through all phases of the investment lifecycle, gives GIV Partners an edge in managing risks and delivering superior returns.

GIV Partner’s ability to create value across property types and investment styles provides investors an opportunity to achieve attractive returns and a sound diversification.

For more information regarding transactions executed by

GIV Partners and its shareholders see Selected Transactions.

Property Types

Office Retail Industrial Residential CorporateInvestment Styles

Core Value Added OpportunisticOffice

Office property tends to outweigh all other property types in most institutional portfolios. The founding shareholders of GIV Partners have acquired and/or managed in excess of 3.5 million square feet of offices across different cities and countries. GIV Partners places a special emphasis on well-located,

quality assets, in major metropolitan supply-constrained markets, which tend to have greater liquidity and hold value better through cycles.

Retail

The term Retail is usually employed to label a wide array of sub-segments including high-street retail, retail parks, shopping centers and a number of other formats. The founding shareholders of GIV Partners have acquired, developed and managed in excess of one million square feet of retail. The quality of the operator and the expertise in managing retail schemes, much more than in other property types, plays a key role in maximizing operating income and as a consequence realizing maximum value from this asset class. GIV Partners focuses on assembling high quality teams and taking advantage of its global network to enrich and improve local schemes with the use of international expertise.

Industrial

The founding shareholders of

GIV Partners have acquired, developed and managed in excess of one million square feet of projects for distribution and storage. As a sector in which availability of land is generally greater, and construction periods typically shorter than in most other property types, GIV Partners tends to focus on cost-competitive assets in

hard-to-replace strategic locations.

Residential

Whether for sale or for rent, being able to deal with the different cultural and legal frameworks that shape demand in each country/city is essential to defining the right strategy and achieving a proper execution for a successful exit.

The founding shareholders of

GIV Partners have invested in residential development projects encompassing over 750,000 square feet of sales area. GIV Partners tends to focus in development and redevelopment of

for-sale residential projects, with a special emphasis on the quality of the design and the features that will capture the psychology and lifestyle of the end users.

Corporate

The founding shareholders of

GIV Partners have significant experience investing in and operating through listed vehicles, as well as managing joint venture partnerships and private companies in different jurisdictions.

In addition to their track record as principal investors, the founding shareholders of GIV Partners have advised prime corporations in Mergers & Acquisitions’ transactions exceeding $3.0 billion in value.

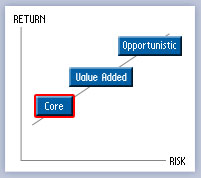

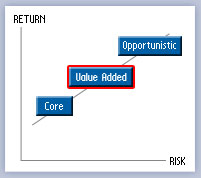

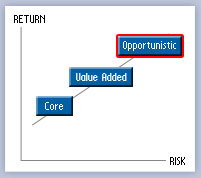

Core

The main goal is to obtain stable current income with lower volatiliy. The focus is on high quality properties, with long term competitive advantages created by a superior location, modern physical characteristics, and strong, stable tenant bases.

Value Added

Seeks to provide investors with an attractive total return. Focuses on assets that provide current cash distributions with the potential to increase in value mainly trough

re-positioning, re-tenanting and other active management strategies.

Opportunistic

Aims to generate capital appreciation for a multiple of the invested equity.

Active management opportunities such as development, redevelopment,

NPLs and other strategies to capitalize on non-efficient market situations.