GIV Partners’ approach to real estate investment is based on

two key pillars:

- an uncompromising focus on Fundamentals, and

- an active approach to Value Creation.

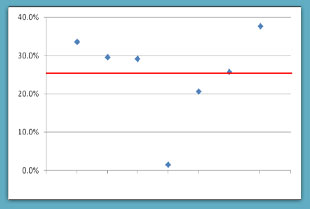

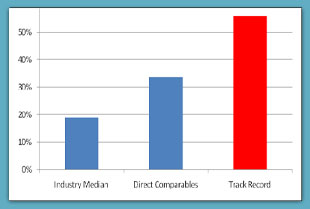

GIV Partners have a proven track record of top quartile performance through different investment cycles. Consistently applying this disciplined approach in the creation and management of its investment portfolios, GIV Partners aims to continue to deliver a superior performance for investors and partners.

![]()

GIV Partners takes investment opportunities through a thorough two-way investment analysis process.

- Top-Down

Macroeconomic, capital markets, and real estate research provide a framework to evaluate growth potential, the evolution of supply-demand fundamentals, and cost of capital for different countries, cities, and property segments, allowing for a proactive identification of attractive market plays as well as the ad-hoc analysis of on and off-market opportunities that make it through GIV Partners deal flow. - Bottom-Up

An in-depth analysis of each asset's strengths, weaknesses, risks and opportunities. Starting with Location, and going through quality, physical condition of the asset, and replacement cost, as well as supply-demand fundamentals and liquidity in the specific sub-market where the property is located, and duration, structure, level and covenant quality of any existing leases.

Ultimately, this analysis serves to support a solid stock-selection process and a strict pricing discipline, which are key to GIV Partners investment philosophy.

Ahead of the last market peak, expecting a cyclical correction in European real estate markets, the founding shareholders of GIV Partners invested in defensive assets. The careful stock-selection based on fundamentals, and a strict pricing discipline upon acquisition paid-off as the crisis hit, with their assets over-performing industry benchmarks by a wide margin.

Ahead of the last market peak, expecting a cyclical correction in European real estate markets, the founding shareholders of GIV Partners invested in defensive assets. The careful stock-selection based on fundamentals, and a strict pricing discipline upon acquisition paid-off as the crisis hit, with their assets over-performing industry benchmarks by a wide margin.  Opportunistic investments require by definition a more active involvement in the process of value creation. The track record of outsized risk-adjusted returns delivered by the founding shareholders of GIV Partners to their sponsors and investors is built upon the same principles. Proactively recognizing threats and opportunities and dealing effectively with complexity are key to delivering a consistent performance.

Opportunistic investments require by definition a more active involvement in the process of value creation. The track record of outsized risk-adjusted returns delivered by the founding shareholders of GIV Partners to their sponsors and investors is built upon the same principles. Proactively recognizing threats and opportunities and dealing effectively with complexity are key to delivering a consistent performance. GIV Partners approaches value creation as a continuous process that extends across all phases of the investment lifecycle. In its “back to basics” philosophy, once the existence of sound fundamentals has been established, GIV Partners primary focus is on adding value.

Creating Value is the only genuine way in which a real estate manager can consistently drive returns across cycles. The value added to the investments will deliver upside in a normal market, and allow the portfolio to outperform competitors in both upward and downward cycles, since it provides a cushion that works as a better risk protection to preserve capital during crises. Introducing innovation, improving efficiency, repositioning, creating new concepts, and proactively recognizing threats and opportunities, are at the core of GIV Partners’ day-to-day work on its investment portfolios.

Sourcing Investments

GIV Partners uses its networks through the different markets to source attractive investment opportunities on and off-market.

Identifying and managing risks

GIV Partners completes a thorough due diligence for each investment and establishes a comprehensive business plan detailing the actions to be taken to enhance the value and exit each acquisition.

Using local knowledge

Having done business in over 10 different countries, the founding shareholders of GIV Partners understand the importance of grasping value drivers, standards, requirements and regulations as well as cultural differences in each market. With a proven track record in identifying and leveraging off

best-in-class local partners and service providers, the founding shareholders of GIV Partners understand that their key competitive advantage over other investment and private equity real estate firms is that GIV Partners does not simply provide capital, but rather engages in an active relationship to contribute its know-how and creativity to the local partners in an effort to make their joint investments outperform the market. Through this active approach, which boosts investment performance and at the same time helps local partners grow and achieve better results for themselves, GIV Partners focuses on establishing long-term relationships and becoming a partner of choice for continued business opportunities.

Structuring

GIV Partners pays close attention to the legal and financial structure of each investment for both equity and debt, as effectively managing the investment vehicles, joint venture partnerships, and financing (amount, terms, covenants, maturities, interest rate hedging) are key to controlling risks and maximizing returns.

Hands-on Asset Management

GIV Partners participates and monitors closely the design and construction phases to maximize property value in those assets that present development or redevelopment opportunities, and actively oversees its property managers to improve tenant services and enhance operating revenues in its rental properties.

Exiting the investments

GIV Partners periodically analyzes and revises potential exit alternatives and strategies for each investment, and takes on an active role in the marketing and negotiations at the time of sale.